Help without hurt.

The private platform for personal lending.

We handle servicing so you don't have to.

When someone you love needs help.

The call comes. A family member, a close friend, someone whose success you're invested in—they need financial support.

You want to help. But you've seen what happens next.

The awkward conversations. The unspoken tension at holidays. The commitment that becomes a wedge. The relationship that shifts from equals to debtor and creditor.

You've watched money—given with love—become the thing that damages what it was meant to protect.

You give. We handle the rest.

FriendlyBank is the layer between your generosity and the relationship you're protecting.

You are the one that helped. We handle all the details. You preserve the relationship. Friendly when things go right. We take care of thing when they do not.

Your Circle member receives clear terms and respectful treatment. You receive clarity and distance. The relationship stays intact.

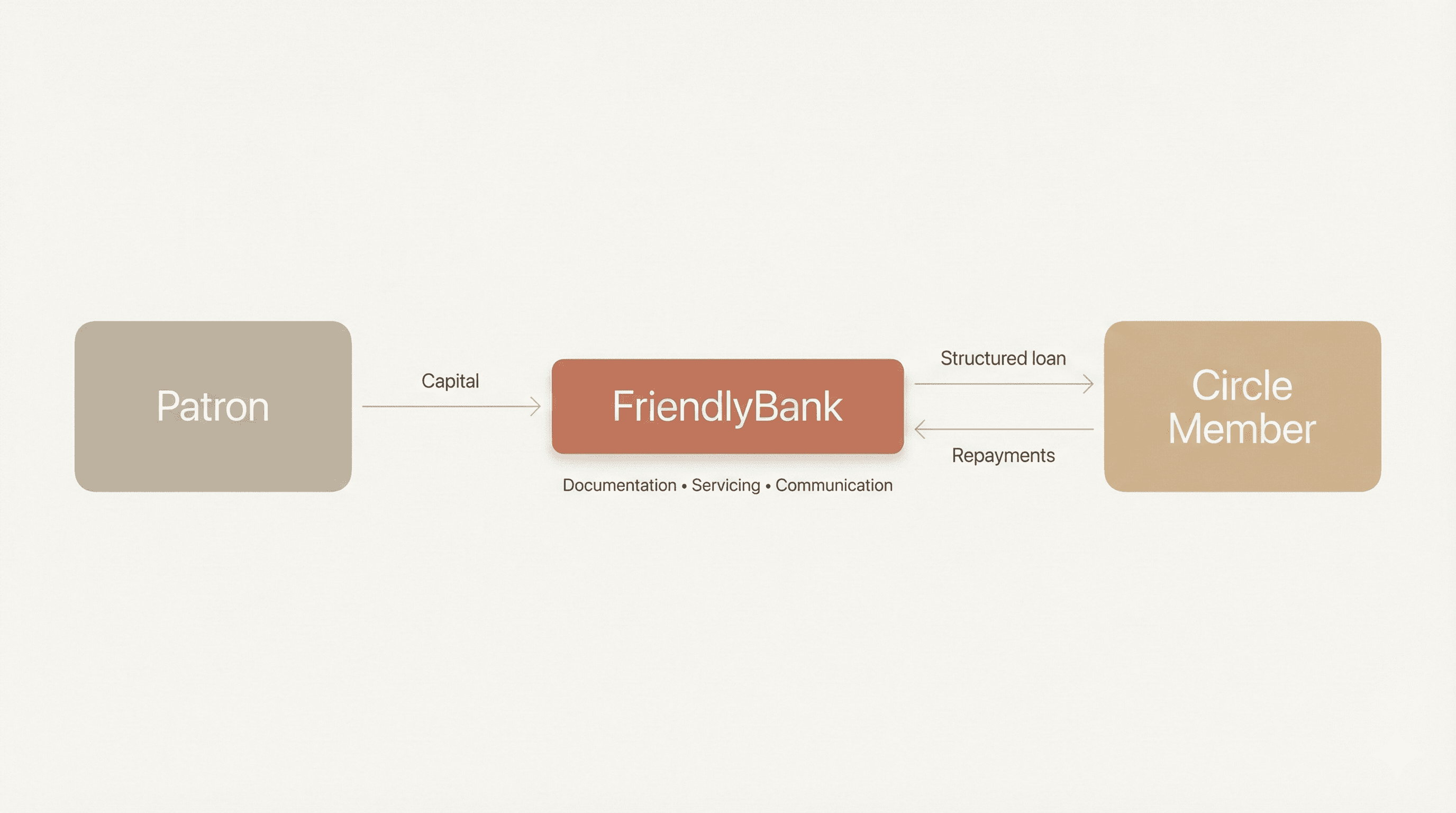

How the relationship works

You provide the support.

The funds come from you. The generosity is yours. The terms reflect your wishes.

We provide the structure.

Legal documentation, repayment scheduling, reminders, collection, reporting—everything operational.

When things get difficult.

Most commitments proceed smoothly. When they don't, FriendlyBank handles it — professional follow-up, clear communication, and real options. We're firm about obligations. We're also respectful throughout. Your Circle member is treated with dignity, even if they're struggling. That protects the relationship as much as the structure does.

The relationship stays yours.

No awkward conversations about late payments. No tension at family gatherings. No change in how you see each other.

Set up once. We handle everything after.

You'll provide basic information and complete identity verification. Our support team is here if you need help.

You'll establish your personal lending framework—maximum amounts, preferred terms, how you want to be notified. We enforce your limits automatically. When a request exceeds your boundaries, FriendlyBank declines it so you never have to.

You control who can access your Circle. Each invitation includes a respectful explanation of FriendlyBank. Existing informal loans can be documented and brought into the system.

Requests arrive as clear, one-page summaries. You'll see our underwriting analysis, our assessment of relationship dynamics, and our recommended terms—but the decision is always yours.

For approvals, we prepare documentation. For counters, we help you propose alternative terms. We also ensure your terms meet IRS requirements. For declines, we provide language that's honest and kind. You never have to craft a difficult message.

You're the lender; FriendlyBank is the servicer and point of contact. We generate legal documentation, transfer funds, send payment reminders, collect repayments, and provide you with regular reporting. If issues arise, we manage them professionally—reminders, escalation, collection—all handled by FriendlyBank. Your Circle member's operational relationship is with FriendlyBank—not with you as the creditor.

Decisions that respect both finances and feelings.

Traditional lending looks only at creditworthiness. FriendlyBank adds what actually matters when it's personal.

Relationship Impact Score™

InsightOur assessment of how this loan might affect your relationship—based on loan size relative to your Circle member's situation, repayment burden, existing dynamics, and historical patterns.

Smart Rates™

InsightThe lowest rate that protects you both. We automatically ensure your terms meet IRS 7872 requirements—keeping commitments compliant and out of gift tax territory.

FriendlyBank Risk Score™

InsightOur underwriting blends credit, cash flow, behavioral patterns, and context. You'll see a clear assessment of repayment likelihood—not just a number, but what it means.

When the answer is no.

When the answer is no—whether you decide, or your policies do—we handle it with care.

FriendlyBank provides suggested language—honest, kind, and designed to protect the relationship.

Or let FriendlyBank decline automatically based on your policies—you never see the request.

"This decline may cause tension. Consider this approach instead..."

We help you say no in a way that preserves what matters.

Generosity, protected.

FriendlyBank provides the institutional infrastructure behind your personal support—so you can focus on the relationship, not the operations.

When things don't go as planned.

You'll never chase a payment or have an awkward conversation about money. If a Circle member falls behind, FriendlyBank handles it—professional escalation, clear communication, and if necessary, collection. We protect your generosity and your relationship.

Your wealth, walled off.

Circle members see only what you offer them—never your total assets, other commitments, or anyone else in your Circle. Your full financial picture stays private.

Tax-ready from day one.

Every loan is documented to IRS standards. Interest rates automatically meet AFR minimums. Your CPA gets clean records for estate planning and tax reporting.

Your team has access

FriendlyBank integrates with your existing advisory structure. Delegate access to your family office, financial advisor, or attorney from day one.

Ready to begin?

Get started in minutes — or talk to our team if you prefer guidance.